1031 tax deferred exchange meaning

For example if you purchase a property for 300000 and five. The Tax Deferred Exchange.

1031 Exchange Explained The Basics For Real Estate Investors Broadmark Realty Capital

The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save.

. A 1031 exchange is similar to a traditional IRA or 401k retirement plan. Tax deferral is a tax-strategy that pushes out the due date on taxes for gains on an investment. You can sell a property held for busines See more.

What Does Tax Deferred Mean. However in order to. For real estate investors 1031 exchanges create an opportunity for investors to move from one property to another and provide tax benefits for.

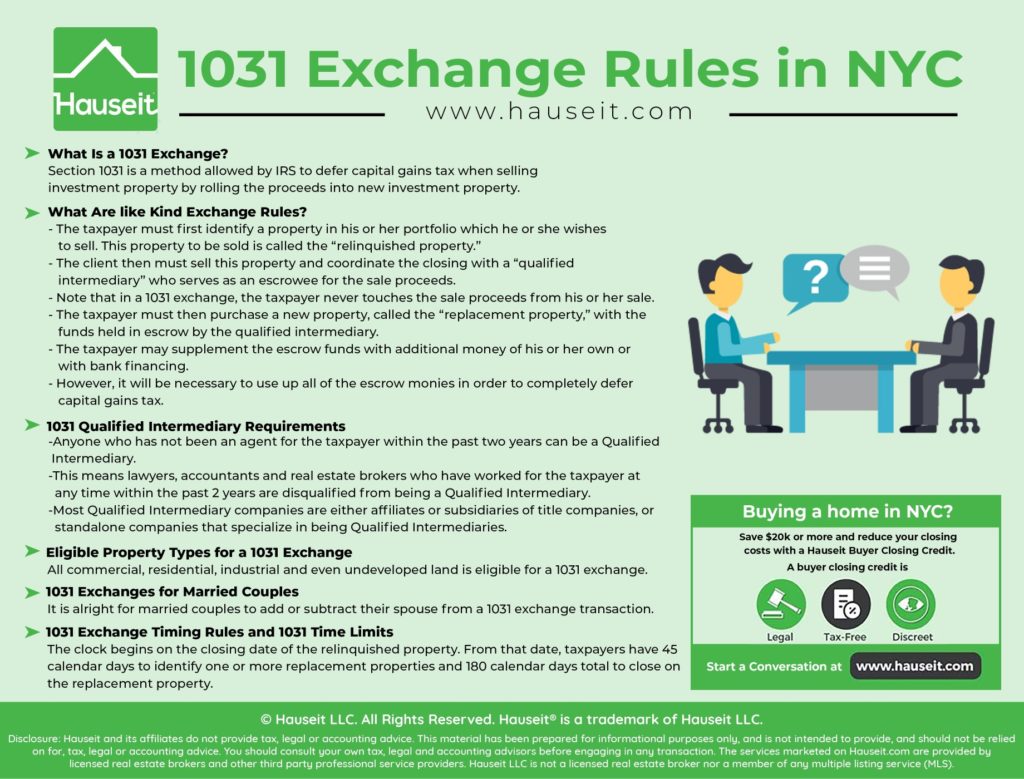

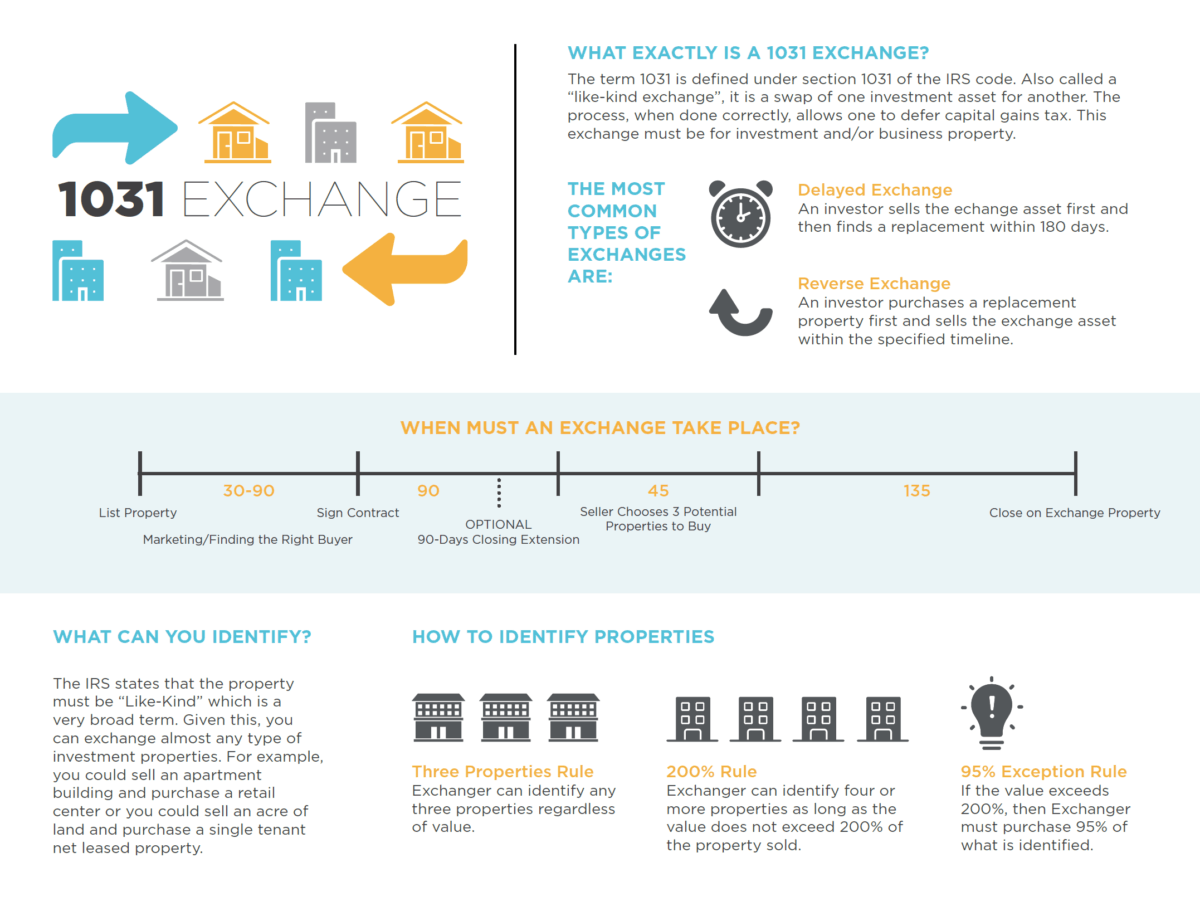

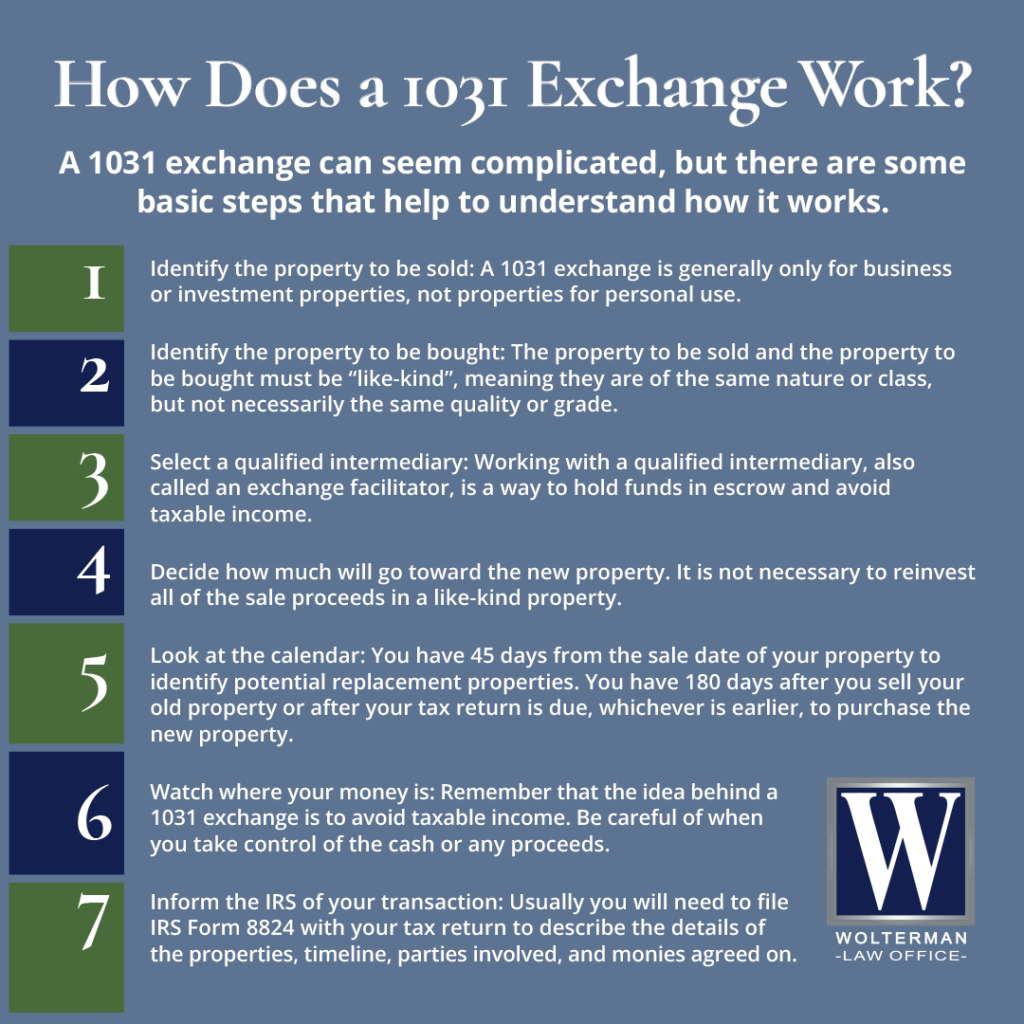

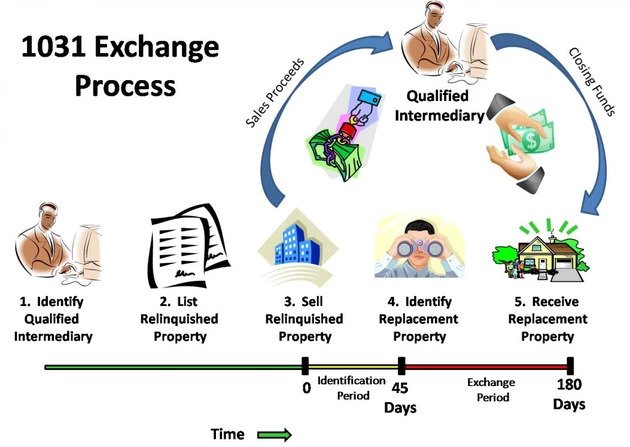

1031 Tax Deferred Exchanges. 1031 Tax-Deferred Exchange Timeline To qualify as a 1031 exchange you must normally identify the replacement property within 45 days of the sale of the relinquished. When someone sells assets in tax-deferred retirement plans the capital gains that would otherwise be taxable are.

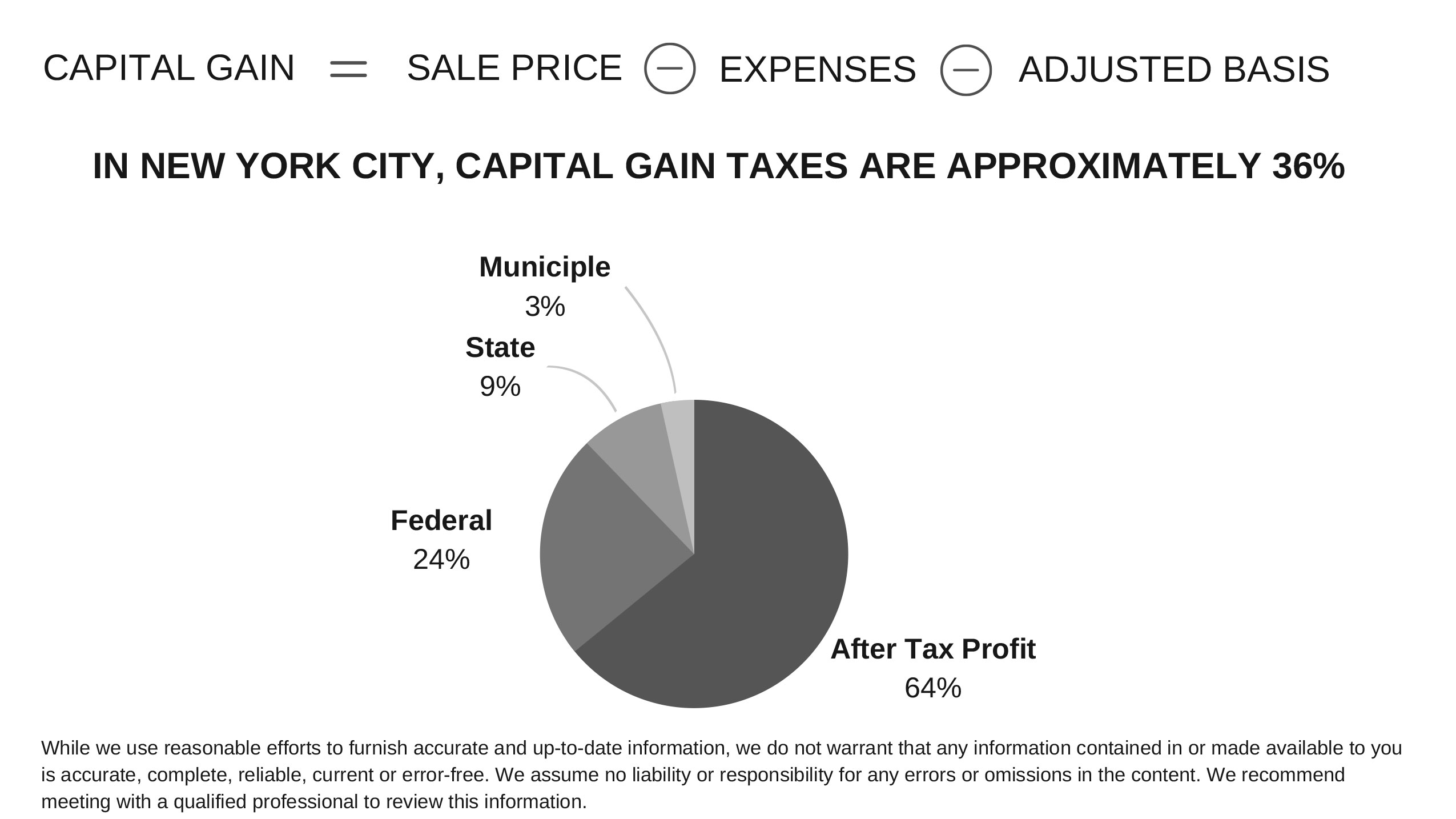

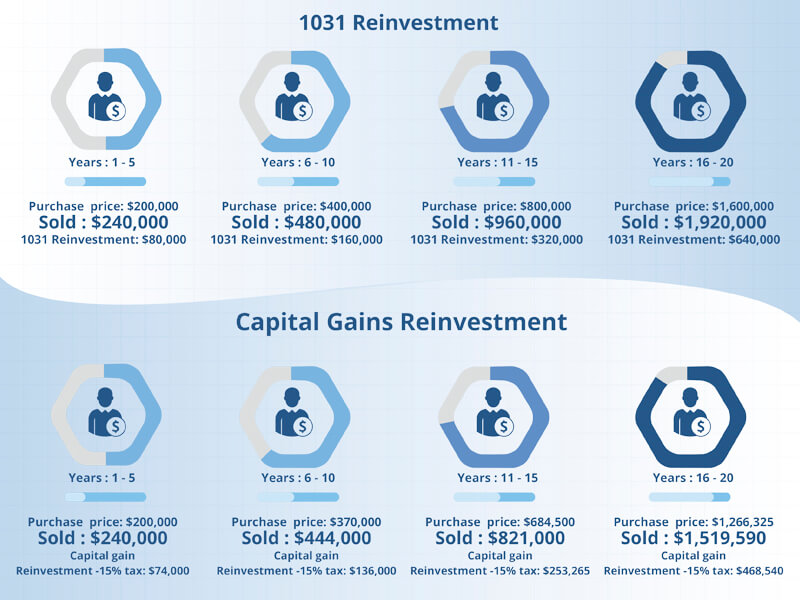

Also known as Like-Kind. A 1031 exchange allows you to defer capital gains tax thus freeing more capital for investment in the replacement property. Those taxes could run as high as 15.

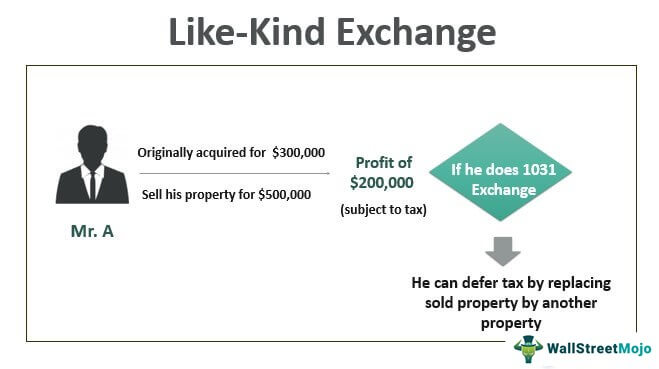

A 1031 exchange gets its name from IRC Section 1031 which allows you to avoid paying taxes on any gains when you sell an investment property and reinvest the proceeds into. Under Section 1031 of the IRS Code some or all of the realized gain from the exchange of one property for a like kind property may be deferred. If your long-term capital gains tax rate is 20 that means youd owe 60000 on the sale of that property.

Like-kind refers to the intended purpose of the property rather than the exact description of the. Its important to keep in mind though that a 1031 exchange may. A 1031 exchange lets you sell your business property or investment and buy a similar property with the deferment of the capital gain taxes.

If that same investor used a 1031 tax deferred exchange with the same 25 down payment and 75 loan-to-value ratio they could reinvest the entire 200000. As part of a qualifying like-kind exchange. A tax-deferred exchange is a method by which a property owner trades one or more relinquished properties for one or more replacement properties of like-kind while.

Specifically the tax code referring to 1031 Exchanges in IRC Section 11031 reads opens in new tab No gain or loss shall be recognized on the exchange of real property held. Thanks to the 1031 exchange you can reinvest the profits into. What are the benefits and considerations.

A 1031 exchange is a swap of one real estate investment property for another that aIRC Section 1031 has many moving parts that real estate investors must undersIf you are considering a 1031 exchangeor are just curioushere is what you shoulA 1031 exchange is a tax break. The exchange can include like-kind property. A 1031 exchange allows real estate investors to sell one property and roll those proceeds into a like-kind replacement asset.

By doing this investors can defer tax liabilities. A tax deferred exchange is a transaction that permits taxpayers to sell an asset held for investment or business purposes use the proceeds to purchase a like kind investment and. It is not a tax-free event.

1031 Tax-Deferred Exchange Definition. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred but it is not tax-free. That would allow for the.

The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

Definitions And Rules Of A Deferred 1031 Exchange Republic Title

How To Do A 1031 Exchange In Nyc Hauseit New York City

Guide To 1031 Exchanges 1031 Crowdfunding

The Basics On 1031 Simultaneous Tax Deferred Exchanges 1031 Exchange Place

Top 1031 Exchange Real Estate Strategy Tips For 2022 Nnndigitalnomad Com

Top 4 Things To Know About 1031 Exchange Destination Real Estate

1031 Exchange Services Ohio Business And Tax Lawyers

1031 Exchange Faqs 1031 Exchange Questions Answered

6 Steps To Understanding 1031 Exchange Rules Stessa

1031 Exchange Rules 2022 How To Do A 1031 Exchange

Never Pay Taxes Again With The 1031 Exchange

Register Now For 1031 Tax Deferred Exchange Webinar Illinois Realtors

1031 Exchange Details Cai Investments

1031 Exchanges Schindler Real Estate

1031 Exchange In Nyc Investment Strategies Nesyapple

1031 Exchanges Rolling Over Funds Deferred Tax Strategy Makingnyc Home